In the modern retail market, consumer needs are becoming increasingly diverse. How brands can improve customer satisfaction and loyalty through payment experience has become a critical competitive advantage. The Old Navy Credit Card not only provides customers with discounts and rewards, but also creates long-term connection opportunities for brands with consumers. By combining with MoneyCollect's payment innovation technology, Old Navy can provide consumers with a smarter and more secure payment experience in the global market.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

Old Navy Credit Card: Optimization of Retail Payment Experience

The Old Navy Credit Card provides customers with exclusive shopping offers. Cardholders can use this card to pay at Old Navy and affiliated brands such as Gap and Banana Republic, accumulate points and enjoy discounts. This payment method allows consumers to get more value and rewards when shopping, and also improves the brand's customer retention rate.

However, as more and more consumers participate in global shopping and cross-border payments, the Old Navy Credit Card needs to provide its users with a more convenient payment experience in the international market. This is where MoneyCollect's payment technology comes into play.

Also read: PayPal Goods and Services: How It Works, Fees and More

How MoneyCollect Empowers Old Navy

MoneyCollect is not only a payment service provider, but also a leader in promoting global payment technology innovation. Through the cooperation with MoneyCollect, Old Navy can achieve payment coverage from local to global and optimize the payment experience of consumers in different regions. The following are the key advantages that MoneyCollect can bring to Old Navy:

Omnichannel payment integration

Old Navy credit card users not only consume online, but also use the card in offline stores. The omnichannel payment integration solution provided by MoneyCollect can seamlessly connect online and offline payment channels to ensure that customers can get a consistent payment experience in any shopping scenario.

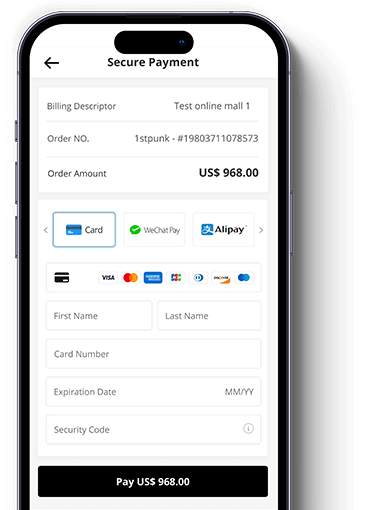

Upgrade of mobile payment

With the popularity of mobile payment, more and more consumers prefer to use mobile phones to complete payment. MoneyCollect's NFC mobile payment technology supports a variety of mobile payment methods, which means that Old Navy customers can easily pay by swiping their cards through their mobile phones without the need for traditional physical cards, greatly improving the convenience of payment.

Coverage of global payment network

MoneyCollect has a wide payment network worldwide, supporting local payment methods in more than 150 countries and regions. Through this powerful payment network, Old Navy can provide global customers with a localized payment experience. Whether using local credit cards, e-wallets, or other localized payment methods, MoneyCollect can easily connect.

Safe and reliable payment system

With the continuous advancement of payment technology, consumers have higher and higher requirements for payment security. MoneyCollect provides real-time monitoring and anti-fraud services through its advanced risk control system to ensure the security of every transaction, providing strong security protection for Old Navy and its customers.

Multi-currency settlement and cross-border fund management

As a multinational retail brand, Old Navy needs to deal with multi-currency settlement and cross-border fund flow issues in different countries. MoneyCollect's multi-currency collection and settlement functions enable Old Navy to manage global fund flows more flexibly, optimize financial processes, and improve fund utilization efficiency.

Old Navy and MoneyCollect: Opening a new chapter in future payment

The cooperation between Old Navy and MoneyCollect is not only limited to the optimization of existing payment methods, but also to explore new possibilities for future payment scenarios. By combining Old Navy's retail experience with MoneyCollect's payment innovation technology, the two parties can jointly create smarter and safer payment solutions to meet the changing needs of global consumers.

For example, with the help of MoneyCollect's payment analysis tools, Old Navy can have a deeper understanding of consumers' payment behavior, so as to customize personalized payment offers and shopping reward programs. This not only helps to enhance consumers' shopping experience, but also brings more business growth opportunities to brands.

In short, with the continuous evolution of the global retail market, payment experience has become an important link for brands to establish deep connections with customers. Through cooperation with MoneyCollect, Old Navy can provide global consumers with smarter and more convenient payment services, further consolidate its market position, and open a new chapter in retail payment.

In the future, MoneyCollect will continue to lead the development of global payment technology, helping Old Navy and other retail brands to continue to innovate in the global market and achieve sustained growth.